Content

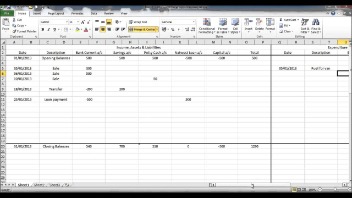

https://personal-accounting.org/ A discovers the billing error and issues a debit note to Company A for the difference of $545 ($5,550 – $5,005). A buyer makes a new order on credit, increasing the total amount owed to a seller for unpaid credit orders made so far, which will need to be settled when the seller issues an invoice at a later date. Company A and Company B post journal entries into their accounting systems to record the respective purchase return and sales return transactions. Debit memorandum is a notification of a debit made on a recipient’s account in the accounting records of a sender. Credit memorandum is a notification of a credit made on a recipient’s account in the accounting records of a sender. The terms credit memo, credit memorandum and credit note have the exact same meaning and are used interchangeably.

Common debit memos include returned check fees, insufficient funds fees, interest fees, fees for printing checks, bank equipment rental fees, and adjustments to incorrect deposits. In certain circumstances, a debit memo is typical in the banking business. When bank charges fees, for instance, a bank can send a debit memo to a specific bank account. A debit note is similar to a credit note, except it’s issued from the buyer’s side. Therefore, debit notes are issued before a credit note can be created by the supplier. Using credit memos ensures that companies receive payment from customers accurately and efficiently. It saves time because customers don’t have to read long explanations about adjustments, refunds, and differences in their bills to figure out what’s going on.

Understanding Credit Memos and How They Relate to Accounting

Debit notes are used in transactions when a debit entry adjustment is required in a case where money is owed. A debit note will stipulate the amount of money owed from one party to another.

- Enter the amount of the credit memo that you would like to apply next to the invoice or debit memo that you wish to apply it to.

- Company B sends the order to Company A, accompanied with an invoice for $10,000.

- A debit memo is common in the banking industry in several situations.

- In this case, the purchaser issues a debit note reflecting the accounting transaction.

- It typically occurs when overpayment has occurred, whether intentionally or due to an error on the part of either party.

- Adjustments to accounts receivable balances can be entered in Practice CS in the form of Credit Memos, Debit Memos, and Write-Offs.

Some companies may also apply a customer’s credit memo to future purchases instead of sending a refund check or adding cashback to the customer’s account. Before sending items back, customers should find out how their company handles refunds and if they will get a refund if they send in a credit memo. They are also critical for preventing fraud by reconciling all invoice discrepancies and quickly identifying and addressing payments.

Debit Receipts

As technology gets better, more and more businesses are using electronic credit memos to send information quickly and safely over long distances. For instance, consider the case where company XYZ returns material to its supplier, company ABC. To prove the amount it should be reimbursed, XYZ drafts a debit note.

This is different from vouchers, which businesses may use to attract new customers by offering discounts or other perks. Business-to-business sales are often made on credit, where a seller provides goods or services to a buyer before an invoice is paid. In the interim, some companies use debit memos to keep track of the amounts due in their accounting records.

Top 10 Reasons to Use a Credit Memo

If the buyer hasn’t paid the seller anything yet, they can only use the credit memo as a partial offset to the invoice. They will still be required to pay what is owed after the reduction specified in the memo.

- The taxes and cost of goods should always be separate line items in the note.

- A credit memo is a separate transaction that amends the original invoice.

- Debit notes and credit notes are almost always involved in business-to-business transactions.

A Debit Memo And Credit Memos In Accounts Payable memo, which is also called a credit note, is what you get when you cancel an invoice or fix an error in a charge to a customer’s account. This action reduces the overall balance the customer owes and will show up as a negative number on their statement. The term “credit” refers to reducing what is owed and allowing money to be returned or given back to the customer.

Debit Note

When issued, debit memos typically appear on the monthly statements of outstanding accounts receivable that are sent to customers. The purpose of these memos is to raise an ad hoc charge or credit not related to a specific invoice. The memo items refer to one-time product rate plan charges. These charges do not have to be part of any subscription. Standalone credit memos can be applied to any invoice or debit memo with a positive balance.

Why would we receive a debit memo from a vendor?

A debit note is a document used by a vendor to inform the buyer of current debt obligations, or a document created by a buyer when returning goods received on credit. The debit note can provide information regarding an upcoming invoice or serve as a reminder for funds currently due.